Travel insurance is a critical factor in obtaining a visa. It’s a significant component of the overall application process, demonstrating your preparedness and financial responsibility to the authorities. This guide delves into the significance of travel insurance for visa approval, highlighting its role in securing a successful outcome for your visa application. This detailed article will address the critical aspect of obtaining the correct travel insurance to ensure that your visa application is well-received, and we’ll address how to secure comprehensive coverage. This includes understanding coverage aspects, such as medical expenses, trip interruptions, and lost belongings. We will also outline the crucial steps for ensuring your insurance policy aligns with visa requirements. Read on to uncover the significance of travel insurance in securing your visa approval.

The Crucial Role of Travel Insurance in Visa Approval

Understanding the Importance

Travel insurance is often a critical requirement for various visa applications, demonstrating your preparedness for potential issues while abroad. It reassures authorities that you have the financial and logistical resources to handle any unexpected situations. Visa officers are more likely to approve your application if it’s accompanied by evidence of travel insurance that covers the entire duration of your stay. This policy safeguards your financial commitments and demonstrates your commitment to responsible travel, increasing your chances of a positive decision from the embassy or consulate.

How Travel Insurance Demonstrates Financial Responsibility

Meeting Visa Requirements

Visa applications often require proof of financial stability, and travel insurance plays a key role in this regard. It assures the authorities that you have a safety net if things go wrong during your trip. If you have sufficient coverage for unforeseen circumstances like medical emergencies or trip disruptions, you can avoid the financial stress that might lead to deportation. Travel insurance, therefore, is not just a suggestion but a vital necessity to support your visa application.

Types of Coverage for a Smooth Visa Application

Essential Coverages

Comprehensive travel insurance should provide coverage for a variety of possible scenarios. Comprehensive coverage for medical emergencies is often a critical requirement for visa approval. The insurance must cover potential medical expenses, including hospital stays and necessary treatments. It should also offer coverage for trip cancellations, delays, or interruptions due to unforeseen circumstances. Lost or stolen belongings, including important documents, are covered by the insurance, which reduces potential financial and logistical hardships. Specific coverage amounts, however, will vary based on the policy you choose.

Navigating Visa Requirements with Travel Insurance

Adapting to Visa Conditions

Visa requirements often vary considerably depending on the country you’re visiting. Researching the specific requirements for your intended destination and ensure that your travel insurance covers the areas specified in those requirements. Some countries demand evidence that your travel insurance covers the full duration of your stay. Different embassies or consulates have different guidelines, so always check with the relevant authorities to understand the precise requirements for your visa application. Failure to meet the requirements, even with a comprehensive insurance plan, can negatively impact your application outcome.

Choosing the Right Travel Insurance for Your Needs

Considerations for Your Trip

When selecting travel insurance, evaluate your specific needs based on the length of your stay, the activities you plan, and your budget. Factor in potential medical risks or travel disruptions. Compare various policies to find the one that best meets these conditions. Always thoroughly read the policy documents to understand the terms, conditions, and limitations. Understanding the coverage amounts, exclusions, and claim procedures is key to a hassle-free experience when seeking visa approval and travel insurance.

Common Mistakes to Avoid When Purchasing Travel Insurance

Ensuring Proper Coverage

One common error is not carefully reviewing the terms and conditions of the travel insurance policy. Scrutinize what’s covered, what’s excluded, and the claim procedures. Another mistake is relying solely on a free online travel insurance tool without comparing other offerings, especially before making your visa application. Also, ensure that the coverage aligns with the visa requirements of your target country. Carefully review the exclusions and limitations before making any decision.

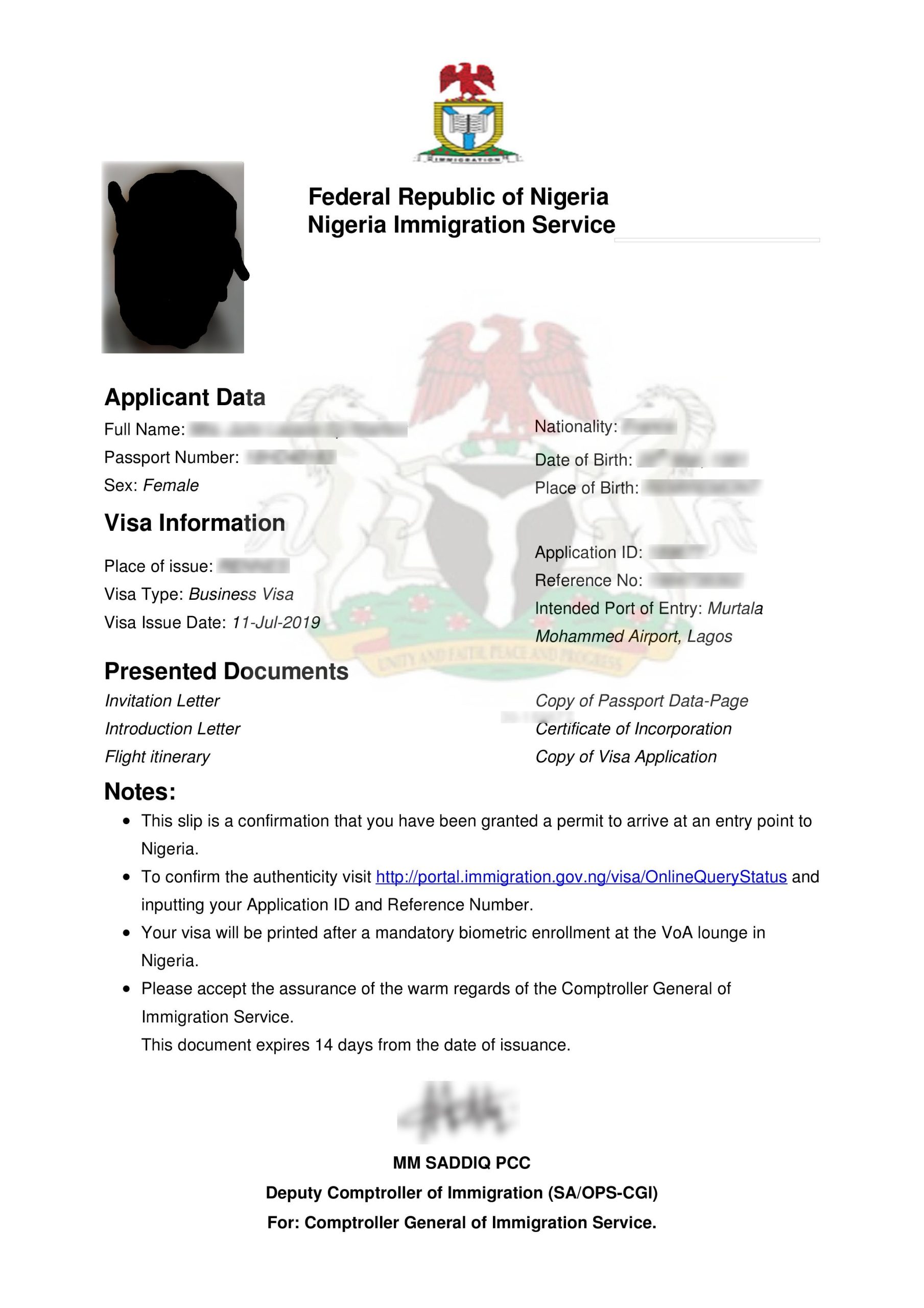

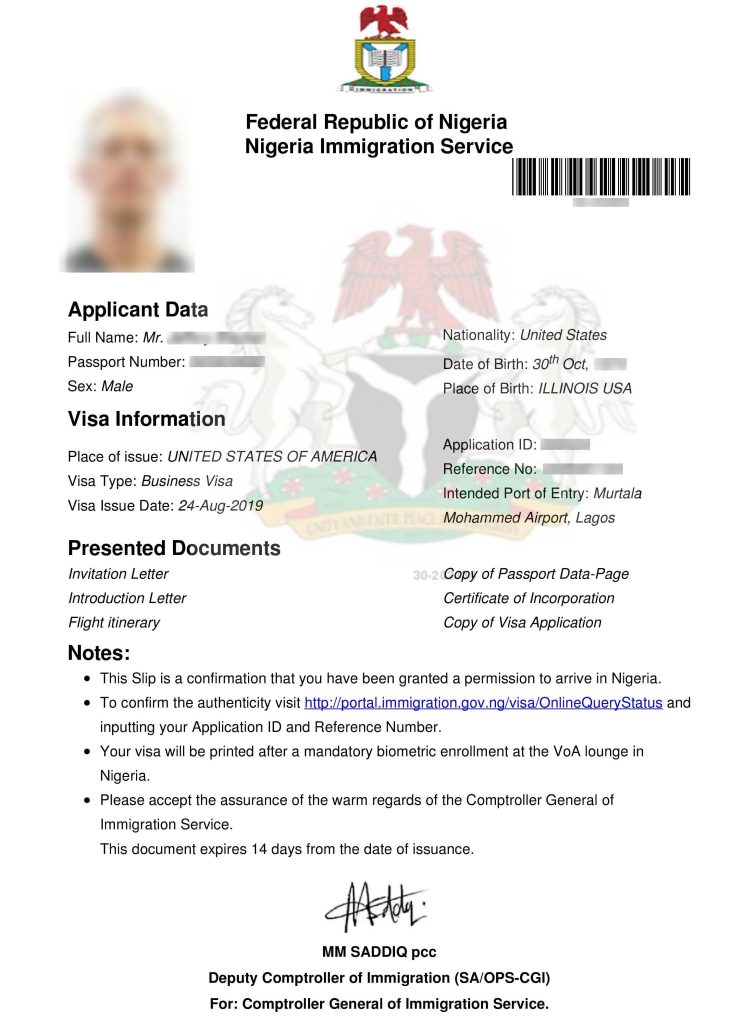

Case Studies: Success Stories with Travel Insurance

Real-World Examples

A traveler seeking a business visa needed to show proof of travel insurance. They secured a policy that covered various aspects of their trip, including medical expenses and emergency situations. As a result, their visa application was processed smoothly and efficiently. Another example of travel insurance successfully supporting visa applications involves tourists who had to cancel their trip due to an unexpected illness. They were able to make a claim on their travel insurance and receive reimbursement for lost expenses, ensuring they maintained a positive image as responsible travelers.

The Bottom Line: Maximizing Your Chances of Visa Approval

Key Takeaways

Travel insurance plays a crucial role in the visa application process, demonstrating financial responsibility and mitigating risks. Understanding the specific requirements of the visa application is crucial for choosing the right coverage. Be sure to cover critical areas such as medical emergencies, trip disruptions, and lost belongings. These measures significantly increase your chances of visa approval. Prioritize travel insurance to enhance your preparedness and ensure your visa application journey runs smoothly and efficiently. Thoroughly checking the terms and conditions is essential to ensure your insurance aligns with your needs.

Additional Tips for Smooth Visa Applications

Additional Considerations

Thoroughly research the visa requirements of your destination country before purchasing travel insurance. Be prepared to provide documentation, such as the insurance policy details, during the visa interview. Furthermore, maintain a high standard of behavior throughout your trip to avoid unnecessary complications or issues with your visa status. Ensure that you carefully review your policy details before submitting your application. A comprehensive review of your insurance policy ensures all bases are covered and avoids potential issues during your travel abroad.

Frequently Asked Questions

What if my travel insurance doesn’t cover medical expenses in the country I’m visiting?

Many travel insurance policies include coverage for medical expenses abroad. However, it’s essential to review the specific terms and conditions of the policy you choose to ensure that your medical needs are adequately covered. Consider purchasing supplemental insurance if necessary to address any gaps in your primary travel insurance coverage. Make sure to carefully read the policy documents and check for any exclusions that might affect your coverage.

How much travel insurance coverage do I need for my visa application?

The amount of coverage needed depends on your individual circumstances, including the duration of your stay, the type of activities you plan, and the overall cost of your trip. While there isn’t a fixed amount, ensuring sufficient coverage to cover potential emergencies or unexpected circumstances during your trip is advisable. Contact your travel insurance provider or a visa specialist for guidance on the appropriate level of coverage for your specific needs.

Can I add additional people to my existing travel insurance policy?

Yes, you can usually add additional people to your existing travel insurance policy, often by purchasing an add-on coverage or by getting a family-oriented travel insurance plan. However, it’s vital to confirm the specific terms and conditions regarding additional coverage with your travel insurance provider beforehand. This often entails purchasing a separate policy or extending the coverage period of your existing policy.

In conclusion, securing travel insurance is crucial for visa approval, demonstrating financial responsibility and mitigating potential risks. Understanding the specific requirements of your visa application is essential to choose the right policy. Ensure that your travel insurance covers potential medical emergencies, trip cancellations, and lost belongings. By following these guidelines and securing adequate coverage, you significantly enhance your chances of visa approval. Ready to protect your trip and your visa application? Find a suitable travel insurance plan today!